The #1 Mistake THC Businesses Will Make This Tax Season

Tax season is right around the corner which means that, unfortunately, Uncle Sam will be looking for his (very large) share. The most important issue facing cannabis companies involved in THC will undoubtedly be IRC Section 280e, which forbids businesses trafficking Schedule I substances from business deductions other than cost of goods sold. Due to IRC section 280e, many cannabis businesses have believed that they could minimize taxes by overstating their cost of goods sold. Unfortunately for us, the IRS has been having a field day with companies trying to shoehorn basic business expenses as cost of goods sold. The tax court is repeatedly ruling in the IRS' favor when cannabis management and their accountants are failing to follow the "intended nature" of IRC section 280e.

This has enormous implications for all businesses in the cannabis industry. With the effective federal tax rate at 37% for cannabis companies nationwide, managing your tax liability is a requirement to run a scale-able business. When it comes to tax planning in this industry, it is important to see the big picture. The penalties for being overly aggressive in tax law applications can be enormous. From long, drawn out lawsuits with the IRS, to massive monetary penalties, loss of license and even prison, it doesn't pay to try to "beat" the tax code. Intelligent, up-to-date planning done with respect to the intended spirit of the law is proving to be a much more viable long term strategy.

So what are companies doing wrong? Let's take a look at the biggest mistake we are seeing time & time again as we come upon another tax season.

The Number One Mistake - Failing to Sequester THC & Non-THC Activities

One of the most powerful tax strategies we have is segmenting between cannabis and non-cannabis business activities and between THC and non-THC activities. While typically a cost accounting nuance, segmenting is especially powerful to us because 280e only applies to our THC related entities. This means that regular business expenses incurred in the non-THC division are, in fact, deductible. The essence of this strategy is we want to isolate THC related activities and "stop the bleeding" of allocating ordinary expenses to this division.

Businesses should be wary of jumping the gun, however. A very common strategy in recent years has been to allocate as many expenses as possible to cost of goods sold in the cannabis division and simply dump the rest into the non- cannabis division. This is bad accounting and will eventually result in massive fines, interest and penalties from the IRS. What companies should be doing is correctly developing a methodology in which they identify cannabis and non-cannabis related activities as well as THC and non-THC. Documentation is extremely important in every part of this industry and this is no different. When the inevitable federal or state tax audit comes, having a documented segmentation policy and procedure can go a long way in establishing credibility with the auditor. Some of the most important assets to sequester are your fixed assets as well as your employees.

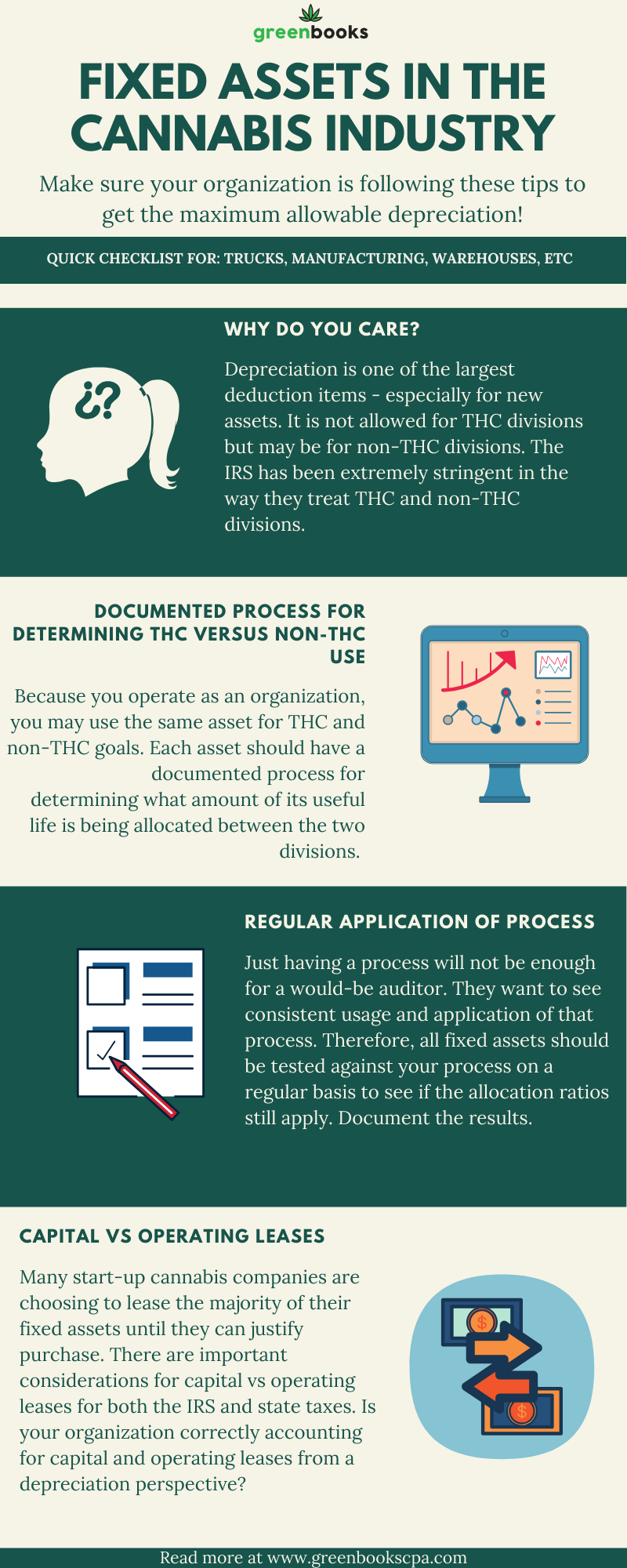

Fixed assets are especially important to sequester as they often offer very high depreciation deductions in the early years of their usable life. Think of every fixed asset in your organization - warehouse, storage center, transportation, manufacturing equipment. Do you have a documented methodology to separate usage between cannabis and non cannabis activity? It could mean the difference between claiming larger depreciation deductions or potentially leaving them on the table.

For an example that is easy to visualize, think about an organization that manufacturers both hemp and marijuana vape products. As the raw material arrives in the warehouse, it will likely be placed in storage for some number of days. Does the organization have designated THC and non-THC storage centers onsite? The manufacturing equipment used to ultimately make the cartridges should be segmented between THC and non-THC activity. This ratio is going to determine the amount of depreciation this organization can ultimately write off on its tax return. Also consider the trucks that will haul the product off to the customer. If the organization owns and operates the shipping portion, they will want to consider the segment strategy for these as well - does it make sense to have THC and non-THC designated trucks?

For businesses that tend to rely on leasing fixed assets instead of purchasing, one must also consider the mixture capital leases versus operating leases. The accounting rules surrounding the treatment for these differ as well, so it is an important consideration.

Another important asset for cannabis organizations to segment is their employees. Our employees are our biggest assets as it they who ultimately bring the product to market. From a cost accounting perspective, their costs should be separated into either direct labor or indirect labor. Tax wise, direct labor covers any costs that are directly associated with preparing our product for market. This is good news for our THC division as it can be correctly allocated to cost of goods sold and thus be deducted as an expense. Indirect labor would be all of our other salaries such as back-office, admin work or any employee that doesn't directly contribute to the final product.

You can see why it would be prudent for all cannabis organizations to clearly define and sequester their employees by cannabis and non-cannabis activities and further by THC and non-THC activities. Labor is often a huge line item expense so ideally we'd like to get the maximum tax benefit of employing folks. In this scenario consider a small cultivator who grows both hemp and marijuana plants. A typical employee is responsible for the day-to-day growing procedures as well as ultimately packaging the final product for both hemp and marijuana. Now from a tax perspective, this employee would be a 100% direct labor cost - meaning no matter their split between THC and non-THC, we would write off their labor. But consider, their manager, who inspects and reviews the work of five other similar employees. Because the manager's time would fall under indirect labor, we need a methodology to determine how much time they spend on hemp versus marijuana.

Now we are not suggesting a solution like time-sheets (although that is a viable strategy). Instead, what most cannabis companies need is to give clear direction to their employees as to their job responsibilities. From a documentation perspective, well written and up to date job descriptions as well as employee policies and procedures can be a god-send. This too, can greatly assist in responsibly dividing employee's expenses among cannabis and non-cannabis activities.

Taxes in cannabis is extremely difficult. If you are having questions or issues you should reach out to a professional. In this environment, it could mean the difference between a profitable business and raising another round of capital.