Cannabis Tax Credits - Research & Development

Tax credits - not exactly a topic that is likely to generate much in the way of excitement. When it comes to the cannabis industry, the tax code can be muddy, especially for companies dealing in both CBD and THC products. For purposes of this article we will be focusing on CBD organizations but that doesn't mean THC companies can't take advantage as well. Please contact us directly if you'd like to speak about you specific situation.

The R&D tax credit is a very powerful credit available to pretty much any organization, regardless of business type. The idea behind this specific tax credit is the federal government wants to incentivize businesses to invest in creating new products, new processes and overall innovation. This tax incentive is available by federal law forever and is also available in a large number of state tax laws. For THC companies, it is crucial to take advantage of the state credit if available.

For cannabis related businesses this is huge! Many cannabis companies, both CBD and THC based have barely even existed for more than five years. This means you're probably spending a good deal of money on developing new products and processes.

So are you eligible for this tax credit? This article will tackle:

What types of business activities have to occur to qualify for the R&D tax credit in the cannabis industry

What are the qualified expenses that can included from those business activities

How the credit can be utilized

Best practices when claiming the credit

Lets get right into it and save you some money.

Cannabis Business Activities to Qualify for R&D Tax Credit

As we mentioned, there isn't really an industry restriction when it comes to the federal R&D tax credit which is great for the cannabis industry. All of the following business types are potentially eligible for the credit including:

Cannabis cultivators

Cannabis manufacturers

Cannabis distributors

Cannabis retail stores

Cannabis dispensaries

Vertically integrated organizations performing one or more of these functions

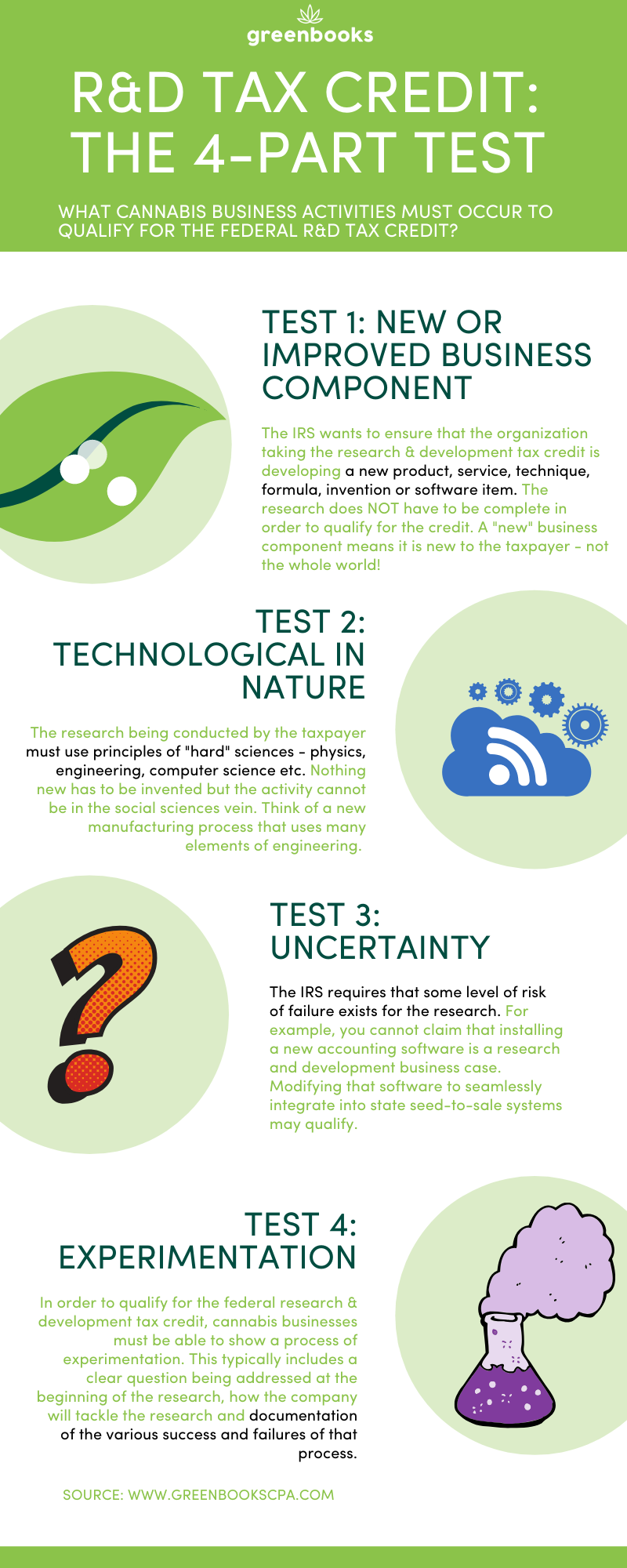

The essence of claiming the credit really comes down to what accountants call the four-part test. High level, the four part test consists of the following:

The company is developing a new or improved business component. Business component can mean any number of things including a new product, process, technique, formula, invention or software item. An important point to note is that "new or improved" means that it is new or improved to the taxpayer. In fact, improvements don't even have to be significant - the company simply must have invested internal resources to attempt the research. Successful research is not even a requirement. That's right, even failed or abandoned research may be eligible for the credit.

The research & development taking place must be technological in nature. This means that the research must use principles of the hard sciences - physics, chemistry, engineering, biology etc. This rule was essentially installed to eliminate any tax credits being taken for research being done in the liberal sciences fields. That means any potential sociology, etc type tests are forbidden from being eligible for the credit. There is a misconception that some new principle has to emerge from the research but using only existing scientific principals is just fine. A good example here is a new manufacturing method may use principles of electrical engineering, mechanical engineering and so on.

There must be uncertainty relating to the development or improvement of the new business segment. In other words, there must be a chance of failure from the new undertaking. For example, realizing you don't have an accounting systems of records and proceeding to sign up for Quickbooks will not net you an R&D tax credit. If, however, you realize no accounting software currently integrates smoothly with state mandated seed-to-sale systems and you decide to build this software from scratch for your company, those costs will likely qualify.

There must be a process of experimentation used to eliminate uncertainties. The important point to understand here is that the IRS wants to see that there was a clear problem or issue to be addressed at the start of the research process. From that problem, new ideas and approaches must have been applied in order to create that new or improved business component. Don't get hung up on the result - remember, the actual outcome is not relevant and the research can be ongoing. The tax authorities simply want to see there was an evaluative process designed to produce new concepts and ideas. Going back to the Quickbooks example - there was no process of experimentation there to solve the issue and therefore that activity would not qualify.

If the business activity fits all four requirements, it is likely eligible for the federal R&D tax credit. If your cannabis company is relatively new, chances are that quite a bit of your activity falls under this umbrella. With no hard cap, the R&D tax credit is indeed a big blessing for the industry.

Determining Qualified Research Expenses

Now that your mind is focused on your prior year business activities that fulfill the four part test, we can discuss which expenses exactly can be claimed in the R&D tax credit.

Qualified Research Expenses fall into one of three categories:

Wages. Typically your heaviest hitter, the W2 taxable salary paid to each employee can be calculated as part of the R&D tax credit as a percentage of the time the employee worked on an R&D project. To give you an idea of how this applies, suppose you had a regular cannabis cultivator who made $80,000 a year in base salary plus equity. If half of this employee's time was dedicated entirely to researching and applying new growing methodologies to increase yield, potentially $40,000 could be a Qualified Research Expense for the company. There are three tiers of employees whose wages can qualify. The direct researcher,who does the actual research and development. The direct support, who helps this individual on their R&D quest, typically with prototype testing and quality assurance. The direct supervision, meaning the direct researcher's manager, at whatever allocation of time was spent reviewing the work. Executive wages ARE allowed here so for folks running a lean shop, maybe the CEO is overseeing the research which is just fine.

Supplies. In this definition, supplies is going to cover raw materials used for prototype or for testing the new product/process. An important distinction to make is that depreciable property is NOT allowed to be rolled into the credit. If you were thinking you could buy some large manufacturing equipment and get an R&D tax credit out of it, just forget it. Going back to the cannabis cultivator, the types of costs that will fall under supplies would be any seeds that the company purchased specifically to test the new growing methodology. You'll also want to forget about trying to lump general & admin costs into this category - for example, no, you can't include your electrical bill as a "supply expense" facilitating your research.

Contract Research. For the R&D tax credit, contract research is going to be expenses relating to when the taxpayer uses a third party to conduct research on its behalf. Using the cultivator example, lets say the employee is on the precipice of a new growing methodology but can't quite finish their experiment. If the research was contracted to be completed by a third party, those expenses may be able to qualify here. Generally speaking, the rule for contract research is that whoever is claiming the tax credit must retain ownership rights of the research. For the cannabis industry specifically, heres the big winner: contract research expenses include certification testing. So for our CBD friends if you have your product tested by a third party to ensure quality, those costs will qualify. Similarly, for THC companies, whatever state mandated testing your product goes through could potentially qualify as R&D tax credit expenses. Eventually we will have to all become FDA approved, which means those costs down the road will fall in here.

The big takeways here are ultimately wages will probably be the key driver for your actual qualified expenses, followed by contract research and than supplies. Don't forget - costs relating to certifications may be qualified expenses so be sure to keep track of those costs.

How to Utilize the Credit

I bet you are starting to understand why this tax credit can go such a long way in the cannabis industry. With all of the new products, innovation in cultivating and manufacturing we've seen in such a short span, we should easily be claiming billions of dollars in this credit. Another awesome thing about the credit is it can be used in a variety of ways. The federal research & development tax credit can be used to:

Offset Federal Income Tax

Offset a portion of Payroll Tax (for qualified cannabis startup businesses)

Offset Alternative Minimum Tax (for qualified cannabis small businesses)

The first option is the classic option for pretty much any tax credit. Some portion of your R&D tax credit can offset your federal income tax liability. Going back to the original purpose of the credit, the government wants to incentivize innovative behavior and will help you pay some bills along the way. I won't get into the calculations here, but think along the lines of about 5-7 cents for every qualified expense. But what if you're operating at a loss or don't owe any money?

Beginning in 2016 qualified startup businesses may now use the R&D tax credit to offset some portion of their payroll tax. This is an outstanding development for us in the cannabis industry as it opens the playing field for marijuana companies to begin claiming this credit. For this definition, a startup business is a company with less than $5 million in gross receipts. This is also a good news story for organizations that are still producing a small or no income tax liability. Payroll taxes are mandatory regardless of income and thus we can take a portion of your R&D tax credit and apply it in the current period regardless of how much money you're making.

Finally, qualified small businesses can use the R&D tax credit to offet some of their alternative minimum tax (AMT). AMT has some complicated calculation rules so I won't delve into the details but it can sometimes be a killer to growing organizations. Luckily, the federal government allows any company that doesn't exceed $50MM in annual gross receipts to use the federal R&D tax credit against this liability.

With three different flavors of application, there is truly something for everyone in the R&D tax credit.

Best Practices for Claiming the R&D Tax Credit

The cannabis industry still has an issue with proper documentation. We see it all the time as accountants - handshake deals between organizations, poor record keeping for financial transactions, and unclear work-papers. The IRS tends to be protective of tax credits and the R&D credit is no different. They will expect a certain level of documentation the cannabis industry is known to be lacking. In order to confidently claim the credit and substantiate your claim in the event of an audit, the cannabis company should adhere to certain standards of documentation including:

Financial

Project

Organizational

As we discussed above, only certain types of costs may fall under the category of Qualified Research Expenses for the R&D tax credit. Therefore it is important to keep very detailed documentation in terms of how you arrived to the numbers you've presented to the IRS. Most often you'll find yourself preparing a spreadsheet as you'll have to allocate employee's time to R&D qualified and non-qualified business activities throughout the year. Similarly, for any expenses being taken for supplies, it should be clear how you came to a monetary figure. Ideally, those costs came from a single purchase order. And of course the same should apply for any contract research and certification testing. In a perfect world you would have all of this maintained and bundled ready to hand over to an IRS auditor at any time explaining both the figures and assumptions that went into them.

For project documentation when claiming the R&D tax credit, the IRS basically wants to validate that the project was pre-considered by the company and had an end goal in mind. What they DON'T want is for cannabis companies to staple together a bunch of random costs and call it a research and development project. In order to best protect yourself, you would ideally keep some project documentation for each type of R&D type activity your company is taking on. In that project documentation you want to discuss the project narrative. Some common items would be why did we start this research? What was the end goal? In what ways does the research benefit the company? On top of a project narrative, any additional supporting documentation will help such as time sheets, e-mail communications internally and externally discussing the intended scope etc.

Finally, you may want to consider additional documentation regarding organizational responsibilities. A good place to start is clear job descriptions. If you are hiring a new cannabis cultivator for example, it would be prudent to include in the job description any possible research and development type activities that may be expected from that role. For larger companies, you may want to specific which employees are considered part of the R&D department, what their responsibilities and expectations are.

So obviously this is not an all-inclusive article and only meant to give you the broad strokes of the R&D tax credit in the cannabis industry. Please consult a tax professional before taking pretty much any tax credit (preferably us). We didn't cover all the nuisance here but hopefully you got an understanding as to why this particular tax credit is potentially so powerful in the cannabis industry - both CBD and THC. Please reach out to us directly for any questions and happy tax season!